One of the biggest concerns for traders, whether beginners or professionals, is the risk of losing capital. While profit potential is attractive, financial markets are inherently unpredictable, and sudden volatility can impact even the most carefully planned trades. Recognizing this, TechBerry has introduced a unique feature that sets it apart from many competitors: insurance coverage. In this article, we’ll explore how TechBerry trading works, why its insurance policy matters, and how it helps investors feel more secure in 2025.

Why Risk Management Matters in Trading

Trading always involves a balance of risk and reward. Traditional investment platforms often focus solely on maximizing returns, leaving users exposed during downturns or unexpected market events. Without proper protection, traders may suffer significant losses, leading many to abandon trading altogether.

This is why platforms like TechBerry emphasize not only profitability but also capital protection. By offering built-in insurance coverage, TechBerry ensures that users have a safety net against potential losses.

How TechBerry’s Insurance Coverage Works

Unlike many trading bots or AI platforms, TechBerry has integrated insurance coverage directly into its system. Here’s how it benefits users:

- Loss Protection – In case of unexpected outcomes or extreme market volatility, insurance helps cover a portion of the losses.

- Risk Sharing – Instead of the trader bearing the full weight of potential downturns, the platform shares the responsibility.

- Confidence for Beginners – New traders are more likely to participate knowing that their funds are protected.

- Peace of Mind for Professionals – Experienced traders value the extra layer of protection as they test new strategies with the AI.

This approach reduces the fear factor that often prevents individuals from investing or trading actively.

Advantages of TechBerry’s Risk Management Approach

- Encourages Participation – Insurance coverage motivates hesitant traders to explore trading opportunities without overwhelming fear of loss.

- Builds Trust – Offering protection demonstrates that TechBerry prioritizes user safety alongside profitability.

- Supports Long-Term Growth – By reducing the risk of devastating losses, investors are more likely to stay active on the platform long term.

- Balances Innovation with Security – TechBerry’s AI-driven model is innovative, and insurance adds a layer of stability that reassures users.

Real-Time Monitoring and Transparency

In addition to insurance, TechBerry provides real-time monitoring of trades. Users can track every decision made by the AI, ensuring transparency and accountability. This feature, combined with insurance, gives users a sense of control and trust that is often missing in other trading platforms.

Comparison to Platforms Without Insurance

Most traditional trading bots and even some advanced AI trading platforms lack built-in insurance features. This leaves traders fully responsible for losses, which can be discouraging, especially for beginners.

By contrast, TechBerry trading combines AI-driven automation, consistent performance, and risk protection through insurance. This combination makes it far more appealing to a wider range of traders, from cautious newcomers to professionals seeking safer ways to scale their portfolios.

Potential Considerations

While insurance offers significant benefits, traders should keep in mind:

- Coverage Limits – Insurance may not cover all losses, so understanding terms is essential.

- Market Risks Still Exist – Even with protection, trading involves inherent risks that cannot be eliminated completely.

- Smart Investing Is Still Necessary – Insurance is a tool, not a substitute for responsible investing practices.

Final Verdict

TechBerry’s insurance coverage is one of its most unique and valuable features, setting it apart from other trading platforms in 2025. By reducing financial risks, it encourages more people to participate in trading and ensures that existing users remain confident during periods of uncertainty.

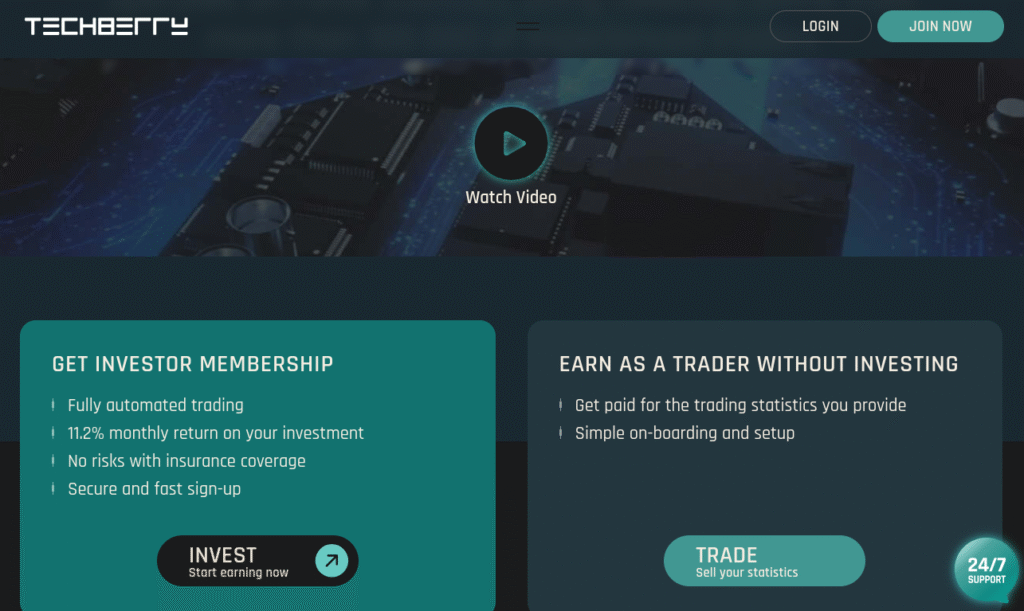

When combined with its 11.3% average monthly ROI, AI-powered strategies, and real-time monitoring, TechBerry stands out as one of the safest and most forward-thinking platforms for modern traders. For anyone seeking a balance between profitability and security, TechBerry trading with insurance protection is a powerful solution.